Roth tsp calculator

The following COVID information was for 2020 Returns. This calculator is programmed to account for this.

Simple Tsp Contribution Percentage Calculator Keep Investing Imple Tupid

As a result of the June 2020 CARES Act retirement account holders affected by the Coronavirus could access up to 100000 of their retirement savings as early withdrawals penalty free with an expanded window for paying the income tax they owed on the amounts they withdrew.

. The regular 10 early. Footnote 1 Any earnings on Roth 401k contributions can generally be withdrawn tax-free if you meet the two requirements for a qualified distribution. Non-Roth Solo 401kthe 10000 deferral is treated as pre-tax thereby reducing Ryans income by 10000 to 50000.

2022 Federal Leave Record. TSP can answer most question on the annuity options. The TSP allows you to save pre-tax dollars in a special personal account.

2022 Roth IRA Income Limits. The Thrift Savings Plan TSP is a special account for Federal Employees. The TSP annuities are purchase through MetLife but they are limited to the offerings listed on the TSP site.

Before moving your TSP savings its important to know some benefits of keeping your TSP in place. The TSP is a retirement savings plan for federal employees. Each year we publish a comprehensive Excel leave record that federal employees can use to track their daily record of annual and sick leave comp and credit hours used.

Secure Log-On for ETRADE Securities and Morgan Stanley Private Bank accounts. However you likely want to go through TSP to purchase your annuity because it avoids the sales commissions and are often a better deal. Do I have to claim TSP on my taxes.

We consider the Roth IRA the rock star of retirement accounts. It is a defined contribution plan similar to the 401k plans that many private employers offer their employees. Most government employees FERS and CSRS are eligible for the TSP even those hired before it was created.

With the introduction of Roth TSP Soldiers have the potential for two types of balances in the TSP account. The pay date is the deciding factor of what year your TSP contributions count towards. Log on to manage your online trading and online banking.

â œDistribution â œ payment â and withdrawal all mean the same thing. To fund a Roth IRA you need earned income which is money you earn through a job or self-employment. Formulate implement and administer DoD policy on Military Personnel Compensation for the total force.

A Roth IRAs beneficiaries generally will need to take RMDs to avoid penalties although there is an exception for spouses. IRA Required Minimum Distribution Calculator. Roth contributions are taken out of the paycheck after income is taxed.

The plan is available to pretty much everyone depending on your income making it a huge part of your retirement investing plan. Car Rental Comparison Tool. When Roth funds are withdrawn they are tax-free.

Married filing jointly or qualifying widower Less than 204000. For example if your last pay period ends in December but pays in January then that TSP contribution is considered to fall in Januarys tax year. It was established by Congress in the Federal Employees Retirement System Act of 1986 and offers the same types of savings and tax benefits that many private corporations offer their employees.

This means Roth TSP contributions are included in your income. The Thrift Savings Plan TSP is a retirement savings and investment plan for Federal employees and members of the uniformed services including the Ready Reserve. You can elect to have part or all of your TSP contributions designated as a Roth TSP.

The Thrift Savings Plan TSP is a retirement savings and investment plan for Federal employees and members of the uniformed services including the Ready Reserve. What should you withdraw. No you should not include your separate TSP contributions on your tax return.

Filing Status 2022 Modified AGI Contribution Limit. It was established by Congress in the Federal Employees Retirement System Act of 1986 and offers the same types of savings and tax benefits that many private corporations offer their employees. The TSP was created as part of the Federal Employees Retirement System in 1986.

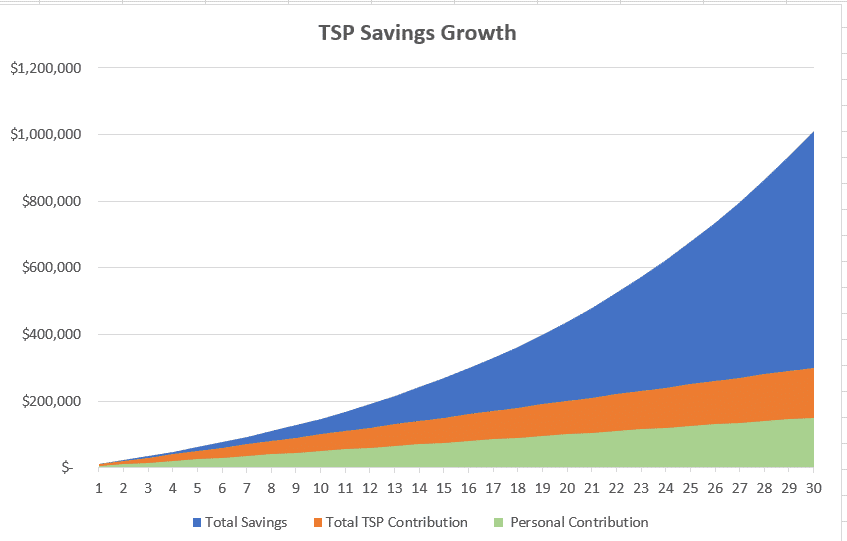

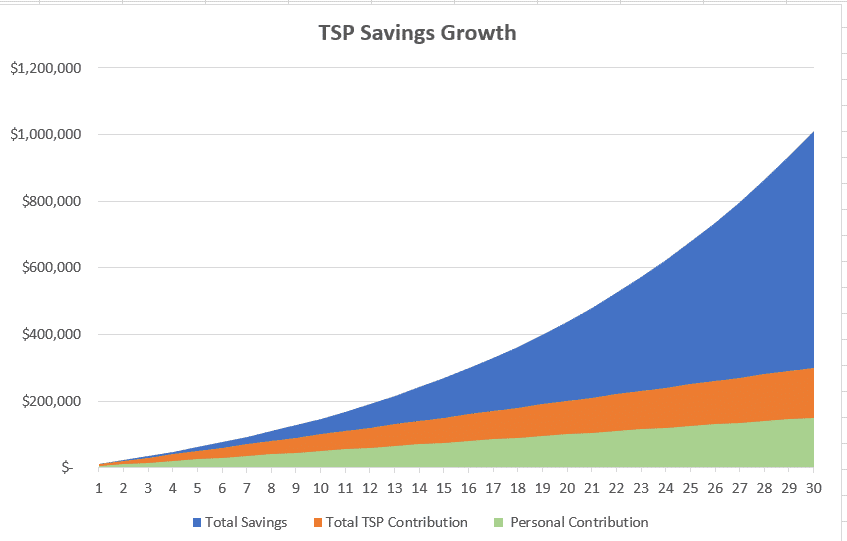

6000 7000 if youre age 50 or older. Finally beyond what you can withdraw from your IRA you might also want to keep in mind how much it really makes sense take outFor instance many retirees use the 4. The retirement income you receive from your TSP account will depend on how much you put into the account plus any matching contributions and the earnings on your investments.

Roth IRA Conversion Calculator. If you take a. The Soldiers own contributions can be designated as traditional TSP or Roth TSP.

Our Mission Develop and oversee implementation of personnel policies that maintain fair and competitive compensation and entitlement systems. It is as if Ryan only made 50000 a year because he is only required to pay taxes on 50000. Besides the missing employer match the biggest difference between a 401k and a Roth IRA is the Roth IRA has a lower contribution limit than a 401k.

1 At least five years must have elapsed from the first day of the year of your initial contribution and 2 You must have reached age 59½ or become disabled or deceased. Money you receive from your TSP account. You do not pay income tax on the portion of your money deducted from your Roth contributions.

TSP is available at. The contribution limits are the same as the traditional TSP. 158 Click Play to Learn About Required Minimum Distribution RMD.

Roth Solo 401k The facts are the same as above except that Ryan chooses to treat the 10000 deferral as a Roth contribution. The calculator assumes your minimum contribution is 6. Your income also cant exceed the Roth IRA income limitsIn 2022 youre ineligible to contribute if your income is greater than 144000 for single filers and 214000 for married couples filing a joint return.

TSP and Roth TSP. The TSP also offers a Roth TSP option which allows you to make after-tax contributions into your TSP account.

Leave Earnings Statement Q A America Saves

Tsp Calculator Store 55 Off Www Wtashows Com

Grow Your Retirement Savings With Your Thrift Savings Plan

Why Transferring Traditional Tsp To A Roth Ira Makes Sense For Many Federal Employees

Tsp Calculator Store 55 Off Www Wtashows Com

Traditional Vs Roth Tsp Knowing The Difference Will Save You Thousands You Re Welcome Blog

Tsp Calculator Store 55 Off Www Wtashows Com

Tsp Contribution Calculator R Militaryfinance

Tsp Calculator Store 55 Off Www Wtashows Com

Simple Tsp Contribution Percentage Calculator Keep Investing Imple Tupid

Tsp Waives Penalties For Coronavirus Related Early Withdrawals Joint Base San Antonio News

Max Your Tsp Contributions 2021 Percent Of Pay To Contribute To Receive 5 Match And Contribute 19 500 By 31 Dec R Militaryfinance

Tsp Contribution Calculator R Militaryfinance

Thrift Savings Plan

Tsp Calculator Store 55 Off Www Wtashows Com

Tsp Contributions And Funds Youtube

Tsp Calculator Store 55 Off Www Wtashows Com